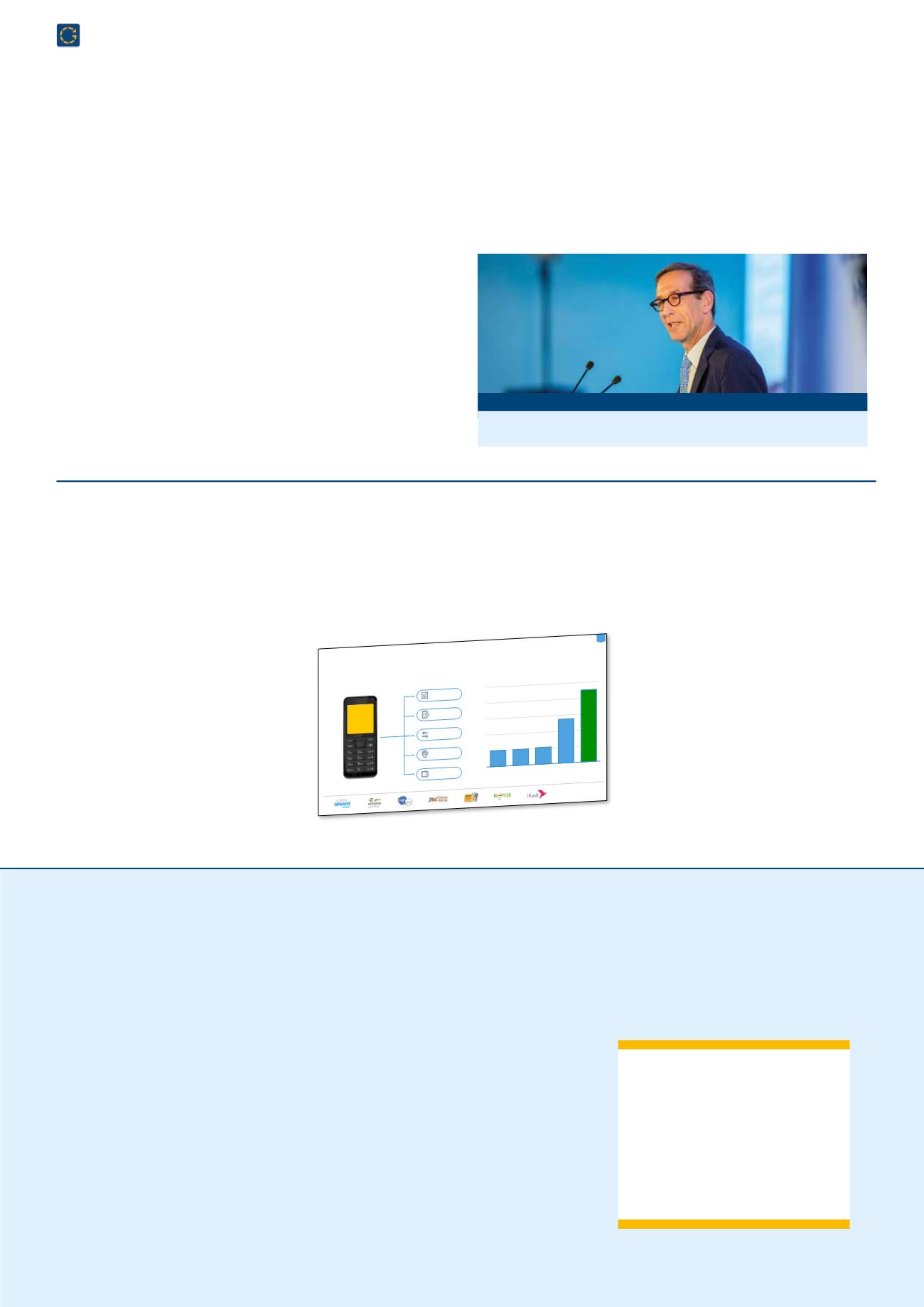

‘The chief beneficiaries of real-time payments will be the customers’,

said Dr Michel Salmony, Equens, whereas the banks and Infrastructures

could be tying up too many valuable resources in getting the rails ready.

Taking UK as case in point, 3

rd

parties acting in the P2P space had

been the first to exploit instant with services such as mobile payments,

pay-day loans and e-commerce payments. Banks used it chiefly for

mobile P2P transfers with small use figures so far. The most disruptive

and innovative use could be in enabling corporates to displace cash and

gain access to ‘just-in-time’ payments. Other promising use cases could

be in instant loans, overdrafts and insurances, betting, all exploiting a

combination of instant and big data.

Mr Leo Lipis, Lipis Advisors, presented their mapping of real-time pay-

ments. 11 countries had real-time systems, and 8 would launch real-time

systems in 2016. Settlement methods varied, but all operated within one

currency and one jurisdiction. In SEPA, a real-time system was in the

design phase. All systems experienced growth and the drivers of growth

were the rise of mobile payments and customer expectations spilling

over to other products. He expected that real-time payments would

soon be common, just as there eventually would be a business case for

them.

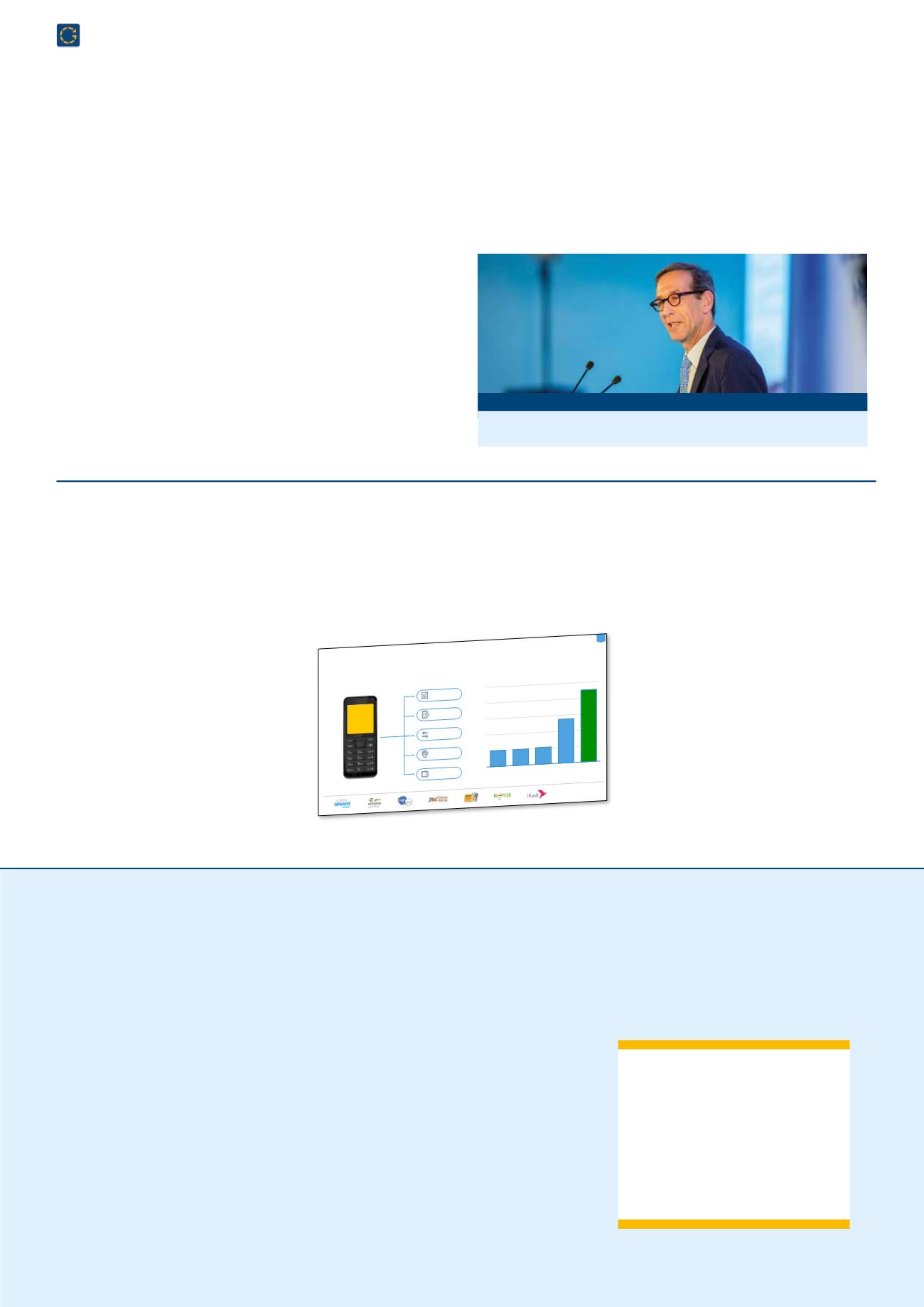

Charles Damen, CEO of TransferTo, described how their hub connected

more than 400 mobile operators across the world and enabled fund

transfers between operators at a fraction of the cost of a usual cross

border payment. They targeted consumers wanting to remit small

funds cost effectively to recipients who had a

mobile phone but had no bank account.

Use options for recipients varied from simple

airtime top-up to paying bills from the mobile

account, paying at a POS or withdrawing

cash. In countries with low penetration of

bank accounts, mobile operators would offer

a variety of services using the phone number

as the account number, and disrupt cash based transfer services or

even displace cash. Clients would perceive transfers as real-time.

The hub would secure one-spot entry to any

destination, one KYC & compliance check-

point, one daily settlement for all pay-out

networks, along with FX service and ad-on

services. Financial institutions could use the

hub to expand reach, reduce transaction

costs and offer real-time payments.

The British FCA regulates TransferTo.

World-wide push for real-time payments

Mobile top-up as payment disruptor

Dr Michel Salmony, Equens

Money Balance:

KES 11.320.85

Type

1-To Pay BILL

2-To buyAirtime

3-To Send to a

friend

4-To pay at Store

5-To cash out

POS PAYMENTS

CASHOUT

P2PTRANSFER

BILLPAYMENTS

MOBILEAIRTIME

Mobile Money transfer is more convenient than cash transfer

Source:GSMA2014

1

0

500.000

1.000.000

1.500.000

2.000.000

2.500.000

WESTERNUNION

AGENT LOCATIONS

POSTOFFICES

COMMERCIALBANK

BRANCHES

ATMS

MOBILEMONEY

AGENTS

Money is spent directly from theMobile…

… or cash-out from the largest domestic agent network

500,000

501,000

524,000

1,376,000

2,260,000

Blockchain was mentioned often at the

community meeting. What is blockchain? Why

should we care? What are the expected use

cases?

Blockchain or ‘Distributed Ledger Technology’,

is the technology behind ‘math-based virtual

currencies, particularly Bitcoin’ (FATF defini-

tion). The technology attracts much interest

today:

•

It handles a decentralized ledger system (a

bit like a database) that can be coordinated

via Peer-2-Peer networks

•

Security and ownership are handled

without a central node. Ownership is

established via exchange of cryptographic

keys, acknowledged by multiple nodes in

the network

•

It promises rapid, inexpensive transfer of

assets between entities, which need not

know nor trust each other, and no interme-

diary is required

•

Crypto-currencies may be used with the

technology to exchange value, often with

an option to exchange to fiat currencies.

According to Lafferty, blockchain may enable

‘the Internet of Money’. It promises to deliver

instant, cheap, easily accessible, tamper-free

‘smart-agreements’. The technology receives

very high attention from the banking industry,

from regulators and from Fintechs – and users

have reported cases of disruptive, as well as

criminal nature, over the past months.

Disruption from new technology - blockchain

“Blockchain is not nec-

essarily disruptive in all

cases; in many industries,

the technology is a solution

searching for a problem”.

Credit Suisse, Blockchain

report, August 2016

4 Eurogiro News